In a move guaranteed to inspire carols of despair and a nationwide sugar plum shortage, the Federal Reserve announced another interest rate hike this week, perfectly timed to maximize holiday financial stress. The decision, lauded by economists for its “unwavering commitment to holiday cheer,” comes just as families finalize their Christmas lists and mentally prepare for the inevitable credit card hangover of January.

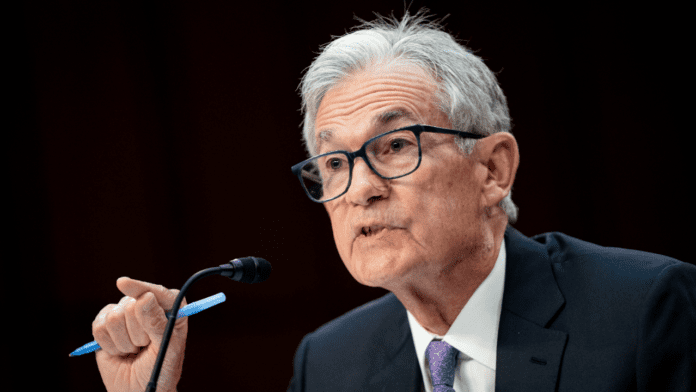

“We understand this may come as a disappointment,” chirped Jerome “Scrooge” Powell, Chairman of the Board of Governors of the Federal Reserve System. “However, studies have shown that a dash of economic anxiety can truly enhance the holiday spirit. It encourages creative gift-wrapping solutions (think newspaper and duct tape!), fosters a deeper appreciation for the simple things (like homemade ornaments), and promotes family bonding over shared financial woes.”

The latest rate hike, affectionately nicknamed “Holiday Scrooge” by disgruntled consumers, is projected to have a devastating impact on the already cash-strapped American public. Experts predict a significant decline in Santa’s workload, with parents opting for “experiences” like board game nights and “educational” hikes instead of the traditional mountains of toys. Retail analysts foresee a bleak holiday shopping season, with stores bracing for an influx of hastily regifted fruitcakes and unwanted sweater vests.

The timing of the rate hike has raised eyebrows (and blood pressure) across the nation. Conspiracy theorists allege the Fed is in cahoots with Big Debt Collectors, seeking to maximize their profits during the post-holiday spending slump. Others point fingers at the “Grinch Lobby,” a shadowy organization rumored to be funded by Ebenezer Scrooge himself.

“This is an outrage!” fumed Mildred Butterball, a disgruntled shopper from Anytown, USA. “Last year I had to choose between buying my grandkids’ presents and replacing my leaky roof. This year, it looks like I’m wrapping up roof shingles for Christmas!”

Meanwhile, politicians used the rate hike as an opportunity to engage in a traditional blame game. Senator Bluster, known for his fiery speeches and questionable economic policies, declared the rate hike a “direct consequence of the previous administration’s reckless spending.” Congressman Pennypincher, notorious for advocating budget cuts to vital social programs, called for a “belt-tightening Christmas,” urging Americans to embrace the “true meaning” of the holiday (presumably, not rampant consumerism).

Undeterred by the impending financial doom, some Americans remain optimistic. “This just means we have to be more creative with our gift-giving,” declared Martha Merryweather, a self-proclaimed “Frugalista.” “I’m planning on baking cookies instead of buying them, and maybe even knitting scarves! It’ll be a fun family activity, and who knows, maybe I can sell some of my handiwork online to offset the rising cost of eggnog.”

Whether Martha’s optimism will prevail remains to be seen. But one thing is certain: this holiday season promises to be a unique blend of festive cheer and financial anxiety. So, get ready to belt out carols of despair alongside your loved ones, because thanks to the Federal Reserve, this Christmas is shaping up to be a real humdinger.

Call to Action: Don’t let the Grinch win! Share this article with your fellow financially burdened colleagues and tag your representatives on social media. Demand that the Fed prioritize holiday cheer over economic “stability.” Remember, the only lump of coal we want this Christmas is the kind that comes in a stocking, not from the Federal Reserve!